Scott Bessent's Coming War Against China

Bessent is hunting for his white whale, and we are all onboard his Pequod

Immediately after Hong Kong was handed back to the Chinese by the British in July of 1997, current US Treasury Secretary Scott Bessent — then only 35 years old and a phenom currency trader working for George Soros’ Quantum Fund — began an infamous financial assault all across Asia. He began in Thailand, and expanded his offensive to South Korea, leaving financial ruin in his wake (and billions in profits).

His bet was that Asian countries were living too high off the hog by valuing their currency at an unsustainably high peg to the US dollar. Thus, he massively shorted Asian currencies by borrowing huge amounts of local currency (Thai baht, South Korean won) and selling them in global currency markets for US dollars. Ultimately, his massive selling quickly burned through market liquidity and would require the foreign government’s central bank to intervene directly to support the peg. He calculated that they would be unable to muster enough US dollar reserves to keep the peg, and he was correct. Thailand and South Korea abandoned the peg, devalued their local currency, and Bessent was able to convert his US dollars back into baht and won at a much depressed rate to pay off his loans. The Quantum Fund profits were in the billions, and Thailand and South Korea suffered massive economic contraction as the governments were unable to service their external debts.

In October of that year, Bessent expanded his currency war to China, via Hong Kong (which, unlike the rest of China, had a freely tradable currency). Seeing the wake of devastation behind Bessent, China marshaled a massive defense of the Hong Kong dollar, raising interest rates and spending a massive amount of foreign reserves to buy back Bessent’s HK dollars at the pegged rate. Eventually, Bessent ran out of financial mortar shells and abandoned the attack, with losses in the hundreds of millions of dollars.

The goal of Bessent’s assault against Asian financial systems was not to simply pocket profits for Soros’ investors (though it was that). The goal was also to politically subjugate Asian countries via IMF bailouts, their last line of defense against total economic collapse. The IMF loans came with the standard set of neoliberal reforms: the scaling down of government through austerity, deregulation, opening of markets, and retreat from state-owned enterprises.

Thailand and South Korea were small fish in the hunt. China was Bessent’s white whale, and the assault on Hong Kong was an attempt to rein it in before economic assimilation began in earnest (China’s entry into the WTO was already being negotiated at the time). But Bessent’s whaling ship simply wasn’t big enough, his firepower too limited.

It is quite possible that nearly 30 years later, Bessent has finally rounded up a big enough ship to go hunting for his white whale once again. This time, he is not a mere privateer for an investment fund, but he has the entirety of the US Treasury at his disposal. And he believes time has run out: it is now or never to bring China down to level, or the American Dream itself is over.

During a recent interview at the Economic Club of New York, Bessent said that “access to cheap goods is not the essence of the American dream… [f]or too long, the designers of multilateral trade deals have lost sight of this.”

By this Bessent means that the US Treasury stands fully behind President Trump’s trade tariffs against Chinese imports, a tactic that Warren Buffett has described as “an act of war.” The strategy is essentially the same as his assault on Hong Kong in 1997. Bessent believes that tariffs will force China to devalue its currency in order to keep its exports competitive in the US market, which was his original goal back then. And once the enemy has capitulated through self-devaluation, then a resetting of the economic relationship can happen under conditions of duress. This is what Yanis Varoufakis has described as “Trump’s economic masterplan” and he has warned against those who believe there is no rhyme or reason to Trump’s tariff threats.

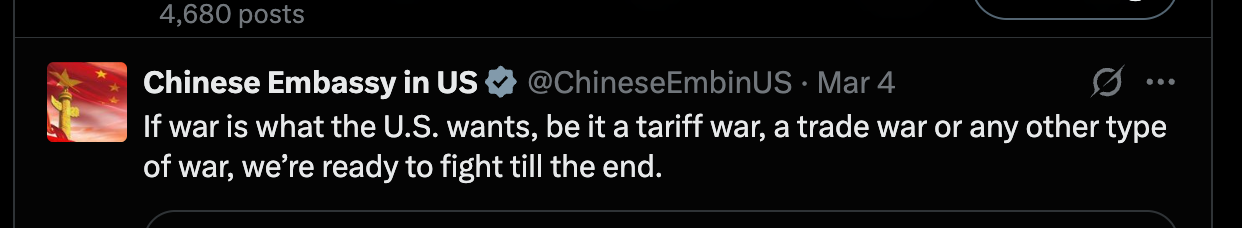

While Bessent’s assault in 1997 is not a particularly well-known event in the United States, it is remembered well inside China. Chinese media at the time narrated the event blow by blow as if it were an actual war. And thus, Bessent’s rise to the position of Treasury Secretary has not gone unnoticed. The rhetoric from official Chinese government outlets has become uncommonly combative since Trump’s inauguration:

We ought to consider what might happen under conditions of “all out economic war” with China, and the limits of Bessent’s stewardship as a currency market speculator. Let us take an example of something the Chinese could do virtually overnight, to which the US would have no defense: destroy our largest company, Apple.

It may seem outlandish that the Chinese would do that, as it would have little economic benefit to them and would open them up for a destructive round of retaliation. But that is non-zero-sum economic logic at play, where the goal is self-maximization. Under the logic of war — the term used by the Chinese embassy above as well as the Chinese government itself — the goal is maximization of damage upon the enemy.

The first question is: could China do it? The answer is yes. Every public company in America has to identify the largest “risk factors” to its public disclosures, and its latest annual disclosure states:

Substantially all of the Company’s manufacturing is performed in whole or in part by outsourcing partners located primarily in China mainland, India, Japan, South Korea, Taiwan and Vietnam. Restrictions on international trade, such as tariffs and other controls on imports or exports of goods, technology or data, can materially adversely affect the Company’s business and supply chain. The impact can be particularly significant if these restrictive measures apply to countries and regions where the Company derives a significant portion of its revenues and/or has significant supply chain operations... For example, tensions between governments, including the U.S. and China, have in the past led to tariffs and other restrictions affecting the Company’s business. If disputes and conflicts further escalate in the future, actions by governments in response could be significantly more severe and restrictive and could materially adversely affect the Company’s business.In other words, Apple doesn’t actually make anything. Its entire supply chain is dependent on Asia, and in particular China. The risk of disruption and perhaps total collapse is disclosed in every single 10-K and 10-Q Apple files. In truth, China could destroy Apple’s entire business overnight by sanctioning its manufacturing suppliers.

The second question is: would China do it? There are reasons to believe it would, beyond the “war” rhetoric noted above (significant as that is).

First, the scale of such a retaliation would be roughly on the order of the size of China’s exposure to the US in the form of its US dollar-denominated foreign reserve assets (roughly $2 trillion). Apple’s total market capitalization is about $3.6 trillion. Thus Apple is an economic hostage of China of roughly the same scale of value as America’s Chinese hostage in this war.

Second, the US has already attempted this exact offensive against China’s technology national champion, Huawei. In a series of targeted sanctions, coordinated with America’s allies, The Economist described the attempt to destroy Huawei as “all out war” and an “assassination attempt”. The low point came in December of 2018, when Canada was directed to arrest Huawei’s CFO (and daughter of Huawei’s founder Ren Zhengfei) Meng Wanzhou, who was detained in British Columbia for nearly 3 years under house arrest.

Imagine then if China made good on the risk Apple has identified to its investors and “impaired” its ability to source iPhones, Apple Watches, MacBook Airs, and whatever else it sells at a clip of $391 billion a year. Imagine the fallout to the US stock market. Consider that DeepSeek’s release of its A.I. chatbot erased over $1 trillion in US stock market value in a single day. What would be the effect on US stock prices were China to launch a coordinated attack against the largest company (by far) on the stock market? What would be the knock-on effects from that in the broader financial markets and the US economy as a whole?

If China were to destroy Apple, the magnitude of the effect would be unimaginable. Yet Bessent, together with his political patron Trump, has stated that challenging China on trade is a matter of “will power”. Trump’s political mandate comes from a large and disenfrachised segment of Americans, who don’t prioritize stock prices as they don’t own much stock. Nor do they own much real estate, or have overpaid white collar jobs that are the first on the chopping block. We cannot assume that violent market reactions will pull Trump back to economic orthodoxy.

This is not a prediction that China will destroy Apple, only a reminder that it could, and that it would not be at all beyond the scope of what’s already been done in this ongoing economic conflict. When we talk of economic war, we must expand our idea of what is possible.

Couldnt they just nationalize the factory instead of sanctioning potential allies and partners?

crapples death will get the attention of the PMC but the real prize will be denuding america of its capital goods and ability to supply electricity and HVAC. imagine the power goes out in any random subdivision in texas and it will take 6 months to get a new transformer installed.